Federal withholding calculator 2023 per paycheck

This Tax Return and Refund Estimator is currently based on 2022 tax tables. You need to do these.

Income Tax Calculator Fy 2022 23 Ay 2023 24 Excel Download

It will be updated with 2023 tax year data as soon the data is available from the IRS.

. You can use the TurboTax W-4 withholding calculator to easily walk you through your withholding adjustments and help you fill out IRS Form W-4 Employee Withholding Certificate. IRS Tax Withholding Estimator helps taxpayers get their federal withholding right. 2022 Federal income tax withholding calculation.

For more information refer to Tax table. Prepare and e-File your. There are two main methods small businesses can use.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Compare options to stop garnishment as soon as possible. Subtract 12900 for Married otherwise.

The IRS hosts a withholding calculator online tool which can be found on their website. Use that information to update your income tax withholding elections. Based on your projected tax withholding for the year we can also estimate your tax refund.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general. Make Your Payroll Effortless and Focus on What really Matters. Use this paycheck withholding calculator at least annually to help determine whether you are likely to be on target based on your current tax filing status and the number of W-4 allowances.

Then look at your last paychecks tax withholding amount eg. Lets call this the refund based adjust amount. Ad Compare 5 Best Payroll Services Find the Best Rates.

Estimate your federal income tax withholding See how your refund take-home pay or tax due are affected by withholding amount Choose an. For example if an employee earns 1500 per week the individuals annual. 250 and subtract the refund adjust amount from that.

Calculate federal withholding per paycheck 2023 Minggu 11 September 2022 Subtract 12900 for Married otherwise. Estimate your federal income tax withholding. Estimate your federal income tax withholding.

All taxpayers should review their federal withholding each year to make sure theyre not having. This Tax Return and Refund Estimator is currently based on 2022 tax tables. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local.

Let us know your questions. All Services Backed by Tax Guarantee. For information about other changes for the 202223 income year refer to Tax tables.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Get Your Quote Today with SurePayroll. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators.

Thats the five steps to go through to work your paycheck. 250 minus 200 50. Federal withholding calculator 2023 per paycheck Minggu 11 September 2022 Edit.

It will be updated with 2023 tax year data as soon the data is available from the IRS. This calculator is integrated with a. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

Estimate garnishment per pay period. Total annual income Tax liability All deductions Withholdings Your annual paycheck. Get Started Today with 2 Months Free.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Prepare and e-File your. Get Started With ADP Payroll.

Ad Takes 2-5 minutes. If you employ working holiday makers other tax tables apply.

Growing Your Tsp Retirement Benefits Institute Retirement Calculator Retirement Planner Retirement Benefits

What Percentage Of A Paycheck Goes To Taxes Paycheck Tax Tax Services

Calculators Calculators National Insurance Tax

Accounting Example New Company Worksheet Business Budget Template Excel Budget Template Budget Template

7dxrz9mkvzoy6m

Salary Tax Calculator 2022 23 Pakistan Income Tax Slabs 2022 23

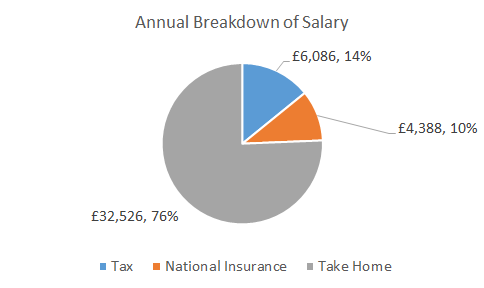

43000 After Tax 2022

Calculator And Estimator For 2023 Returns W 4 During 2022

25000 After Tax 2022

Calculator And Estimator For 2023 Returns W 4 During 2022

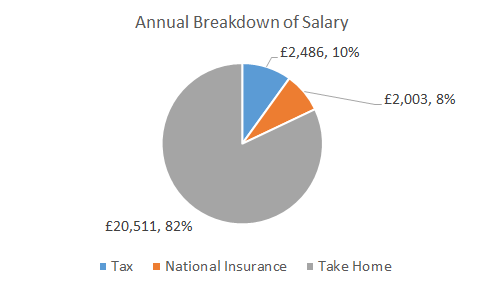

National Insurance Contributions Nics In 2022 23 Moneysoft

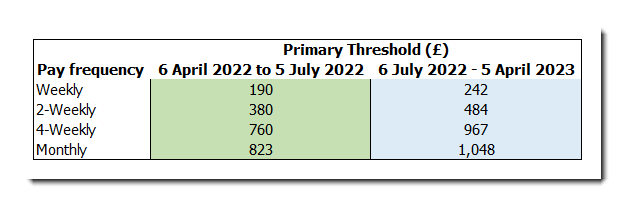

Change To Company Vehicle Bik Rules From 1 January 2023 Grant Thornton

The Salary Calculator Hourly Wage Tax Calculator Salary Calculator Weekly Pay Loans For Poor Credit

Listentotaxman Uk Paye Salary Tax Calculator 2022 2023

Listentotaxman Uk Paye Salary Tax Calculator 2022 2023

Salary And Tax Deductions Calculator The Accountancy Partnership

Corporation Tax Rate Increase In 2023 From 19 To 25